Given that this is a presidential election year, many people have asked what the election will do to the markets and their money. On top of that, an arguably overvalued stock market and a slow-growth economy create more questions of concern. So naturally people are asking about the next 6-12 months. My typical response, one which most of the investment community would share, is to respond with something similar to “What is the purpose of your money?”. There is no denying that the election and the markets impact our finances, but with the right perspective, you can have more confidence in your financial status.

You Cannot Predict the Future

Investments by definition are purchases with incomplete information, with the hope that the value increases and the risk that it does not. This applies to a small business, a rental property, a stock, bond, land, bitcoin, or anything else you can invest in. The first question to always answer when investing is “What is the purpose of this investment”? Investing for the sole purpose of making more money will not lead you to the promised land. Creating an investment portfolio to invest for a comfortable retirement is much more specific and achievable.

When you invest in yourself to start a business, you have a vision for what the business and your life could become. It could take years or decades of hard work and effort to create the life you want. It would seem crazy to approach an owner a few years into their journey and say: “The markets don’t look good; you should sell the company. You could always buy it back when the markets look better again”. This mentality could apply to any financial goal. If you are investing your 401(k) or IRA for retirement in 20 years, does it make sense to sell your investments now and buy them back later? Maybe or maybe not.

The natural objection is some version of “buying low and selling high”. If you sell everything and the market is down the next day (week, month, or year), you look like a genius. Unfortunately, most people don’t think it through. Not only do you need to be one of the only people in the entire market to sell at the top, but you must also be one of the only people in the entire market to buy at the bottom. It is possible, but if it was easy to do then everyone would have done it already.

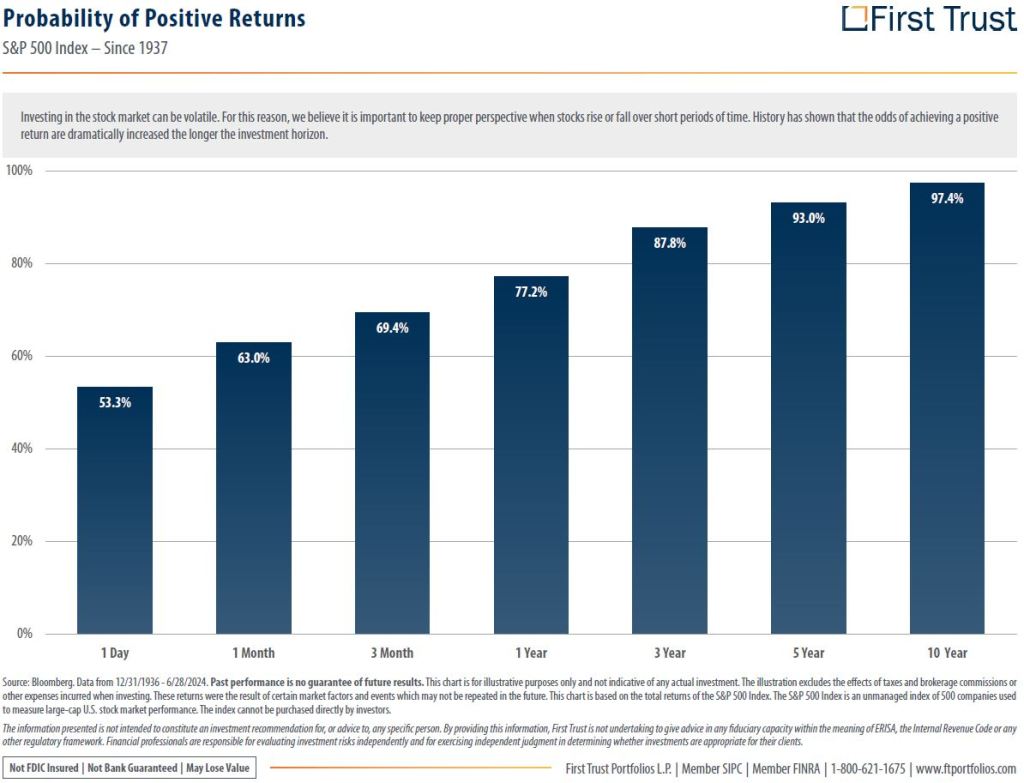

Time in the market usually beats timing the market. As the investment timeframe gets longer, you can typically have more confidence that your investments can grow. Focus on your why and focus on increasing the probability that you reach it. Remember, investments contain risk because they are uncertain. All markets grow and contract over time, and it is possible to make small bets and take advantage of them. But the goal should not be to make more money, it should be the why behind the money.

The Impact of Elections on the Markets

Many people like to threaten to take out all their cash and move to Canada if the opposition wins the election. Backing up from those mostly crazy jokes, many people are naturally concerned that the election, the current economy, or any other event could hurt them financially. It is not possible to say that the election has no impact on the markets. What is possible is to study how elections have impacted investments in the past.

The best proxy we have for this election cycle is to look at previous election cycles and see what happened. According to First Trust1, the S&P 500 had a positive return for 20 of the last 24 presidential election years, with an average return of 11.58%. The average return for the year following an election year is 10.7%. Even split between parties, the average return for election years with an elected Democrat is 8.5%, and a Republican is 15.3%. These are averages and past data, so there is a chance this year could be different. It is possible the market could underperform, or it could perform about average to what we have seen in the last 100 years.

The thought of a party change in the White House or Congress creates uncertainty, which people naturally assume is bad. The election will have important ramifications for sure (one of which I will explain next), and you should do your civic duty to pay attention. However, make every financial decision with your best interest in mind. History shows that the stock market generally rises during an election year. If we assume that to be true this year, ask yourself instead how the election will impact your retirement, business, or any other financial goal you have.

Tax Cuts and Jobs Act

This election cycle has my interest for one main reason. Back in 2017, Congress and President Donald Trump passed the Tax Cuts and Jobs Act (TCJA), changing many tax laws to help individuals and businesses reduce their taxes. In 2026, many of Congress’s changes from more than 6 years ago will disappear, or sunset. It surprises me that so few people are talking about this. Unless Congress passes legislation to continue these provisions, we could see some major changes in the next few years.

Maybe most importantly, it will be interesting to see where personal and corporate tax rates end up. The TCJA permanently dropped the corporate tax rate down from 35% to 21%. Since many small businesses are structured as an S-Corp, partnership, or sole proprietor, they are not bound by the corporate tax rate but instead pass income to their personal tax rates. Trump also “temporarily” cut the personal tax rates down to what they are today and included more tax breaks in the form of credits and deductions. The standard deduction, the estate tax limit, and the child tax credit all were increased via TCJA. With all of these changes set to expire, it is very important to understand what your tax situation could look like over the next few years and see if there are strategies available to lower your taxes.

Two major tax breaks that sunset in 2026 could cost businesses thousands of dollars in taxes. The first, 100% bonus depreciation, allowed owners to deduct the entire cost of a new investment in the year of their purchase. This deduction is already sunsetting, where 2023 only allowed a max 80% deduction, and now 60% for 2024. The other major break is qualified business income deduction. A married couple making less than $383,900 in income could deduct up to 20% of their business income. That is perhaps one of the single best tax breaks available to small business owners (of which many people do not know how to maximize). The elimination of this deduction alone could considerably raise your taxes in 2026.

Focus on Today

A lot is going on in the world of finance right now. An uncertain economy, another presidential election, and sweeping changes in tax laws all require attention. Life will never have a shortage of existential problems to solve. Financially speaking, our job is to educate ourselves and create the best plan for our situation. This includes having a plan for the best and worst possible outcomes. As long as we focus on why we are investing and what the purpose of our money is, we can handle what is thrown at us. The election will no doubt cause uncertainty and concern, and pending tax law changes add fuel to the fire. Each person should build a team of competent professionals around them, control only what they can control, and let the rest be.

Sources: 1First Trust